Unlocking Prosperity: The Power of CDA Loans and Financial Services in North Idaho’s Business Landscape

In today's dynamic economic environment, access to flexible and reliable financial solutions is essential for business success and growth in North Idaho. Among the numerous options available, CDA loans have emerged as a pivotal resource for entrepreneurs and established companies seeking to harness capital for expansion, operations, and innovation. This comprehensive guide explores the vital role of CDA loans, dives into related financial services such as title loans and installment loans, and provides strategic insights to help your business thrive in North Idaho’s competitive market.

Understanding CDA Loans: What They Are and How They Work

CDA loans, short for Citizen Development Authority or often interpreted as a local financing mechanism specific to certain regions, refer to customized lending options tailored to the needs of North Idaho businesses. These loans are designed to offer competitive interest rates, flexible repayment terms, and quick access to funding for various business purposes.

Unlike traditional bank loans, CDA loans are frequently backed by local government or community-based financial institutions that understand the unique challenges and opportunities within North Idaho. Its objectives include fostering economic development, supporting small businesses, and encouraging long-term prosperity.

The Strategic Benefits of CDA Loans for North Idaho Businesses

- Low Interest Rates:CDA loans typically feature lower interest rates compared to other short-term borrowing options, making them cost-effective for business owners.

- Flexible Repayment Plans: Loan terms are often adaptable, accommodating seasonal revenue variations and cash flow management needs.

- Speed and Accessibility: With streamlined application processes, entrepreneurs can secure funding rapidly, vital in competitive environments.

- Community-Centered Support: These loans are rooted in local economic development, ensuring funds are invested back into North Idaho's businesses and workforce.

Key Industries Benefiting from CDA Loans in North Idaho

North Idaho boasts a diverse economy, with thriving sectors that greatly benefit from CDA loans. These include:

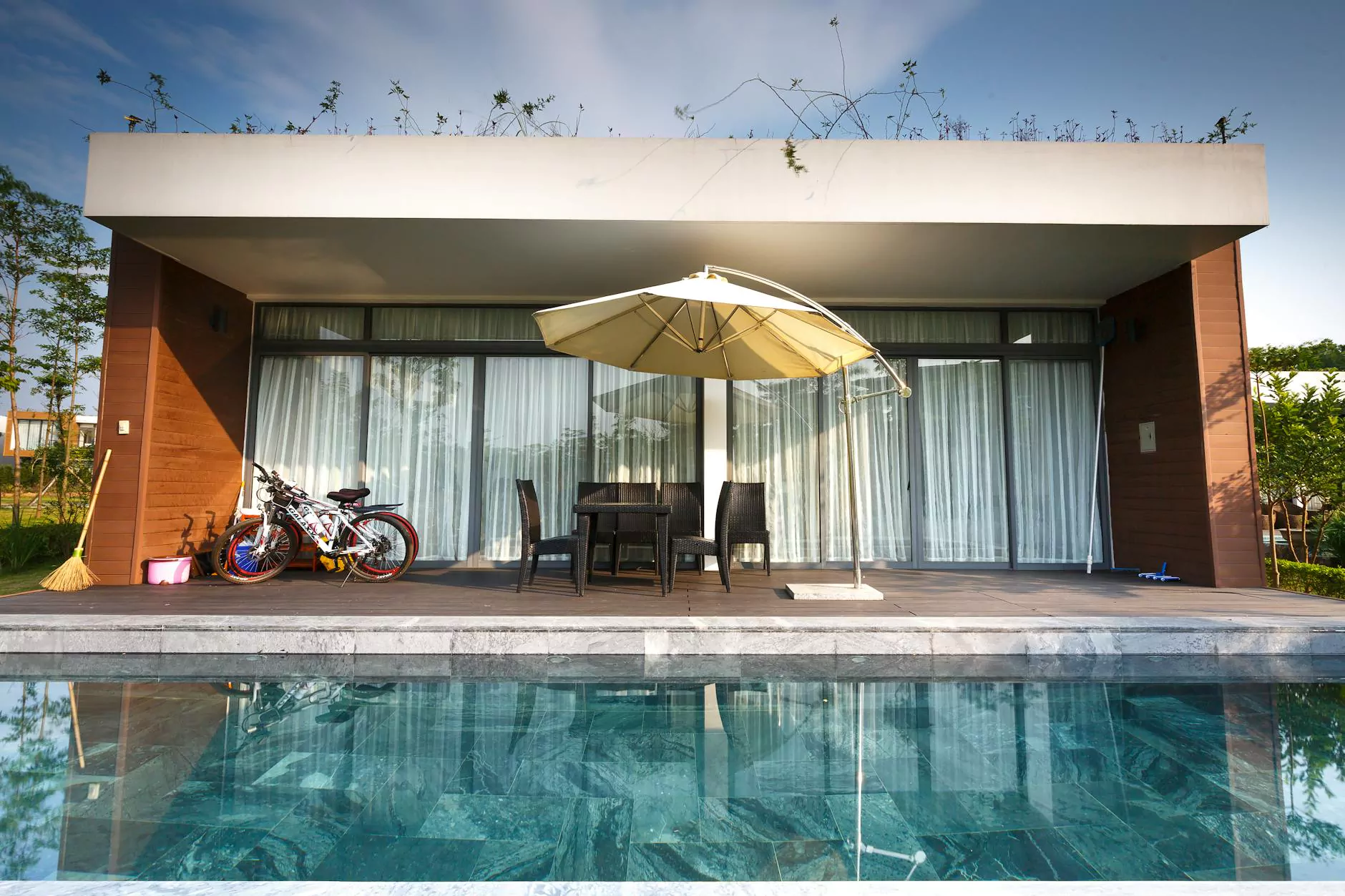

- Tourism & Hospitality: Investing in hotels, restaurants, and recreational facilities to attract visitors.

- Agriculture & Food Production: Expanding farms, processing plants, and local markets.

- Retail & Commercial Development: Building or renovating retail spaces and service outlets.

- Manufacturing & Technology: Upgrading machinery and expanding innovative product lines.

- Real Estate & Property Development: Developing residential and commercial properties to meet regional demand.

Beyond CDA Loans: Exploring Related Financial Services

While CDA loans serve as a backbone for many business financing strategies, North Idaho entrepreneurs often explore other financial products to diversify and strengthen their financial portfolios:

Title Loans in North Idaho: Quick Access to Cash

Title loans offer a fast, secured loan option where the borrower’s vehicle title is used as collateral. These loans are particularly useful in urgent situations requiring immediate cash flow, such as covering payroll, emergency repairs, or rapid inventory replenishment. They typically have a straightforward application process with minimal credit requirements, making them accessible even for those with less-than-perfect credit scores.

Installment Loans: Spreading Out Payments for Long-Term Needs

Installment loans allow businesses to borrow larger sums with the convenience of structured payments over an agreed period. This financial product is ideal for purchasing equipment, expanding operations, or financing large projects. The predictable payment schedule helps manage cash flow effectively, ensuring stability as your business scales.

Why Choosing the Right Financial Service Matters for Business Success

Each financial product plays a distinct role in fueling business growth. The key to achieving maximum benefit lies in selecting the appropriate solution aligned with your company's goals, cash flow cycle, and collateral availability.

Understanding Your Business Financing Needs

- Short-term capital needs: Consider CDA loans or title loans for rapid, smaller funding.

- Long-term investment: Opt for installment loans that allow for manageable repayments over years.

- Collateral options: Evaluate assets like vehicles or property, which could be leveraged for title loans or secured loans.

Factors to Consider When Applying for Business Loans in North Idaho

- Interest rates and fees: Lower rates reduce the total repayment burden.

- Repayment flexibility: Ensure the term aligns with your business cash flow.

- Application process: Simpler requirements mean faster access.

- Lender reputation: Partner with reputable local institutions focused on community growth.

Strategies for Leveraging Financial Services to Boost Business Growth

Effective utilization of financial products involves more than just securing funds. Consider these advanced strategies:

1. Building Strong Credit Profiles

Maintain good credit scores and establish relationships with local lenders to unlock better loan terms and future funding opportunities. Regular payments on existing loans demonstrate creditworthiness and enhance financial credibility.

2. Strategic Investment in Business Expansion

Use financed funds intelligently—invest in high-ROI projects such as marketing campaigns, technological upgrades, or new product lines. This maximizes the impact of each dollar borrowed.

3. Maintaining Cash Flow Vigilance

Monitor receivables, payables, and expenses meticulously. Proper cash flow management ensures loan repayments are sustainable, preventing undue stress on your operations.

Building a Thriving Business Ecosystem in North Idaho

Supporting a vibrant business community goes beyond individual loans and financial products. It involves fostering collaborations, networking, and engaging with local economic initiatives. Here are some ways financial confidence contributes to this ecosystem:

- Supporting Local Employment: Business expansions lead to job creation, benefiting families and communities alike.

- Encouraging Entrepreneurship: Access to manageable loans reduces barriers for startups and small businesses to innovate.

- Stimulating Regional Economic Development: Investment flows into infrastructure, education, and public services, creating a more attractive environment for all enterprises.

Conclusion: Embracing Financial Empowerment with CDA Loans and Related Services

In conclusion, CDA loans and associated financial solutions like title loans and installment loans are instrumental for North Idaho’s thriving business landscape. They provide the capital necessary for expansion, innovation, and resilience in an ever-competitive marketplace. By understanding the intricacies of each product, aligning them with your strategic goals, and maintaining sound financial practices, your business can unlock new levels of success and sustainability.

If you're looking to elevate your North Idaho business through tailored financial services, partnering with local institutions such as Personalloansnorthidaho.com ensures personalized support and expert advice in navigating the diverse world of business financing.

Invest in Your Business Future Today

The journey to a prosperous, resilient business begins with informed financial decisions. Embrace the opportunities presented by CDA loans and related financial products—your pathway to sustainable growth and economic vitality in North Idaho.